Skip to main content

Authority

Authority of PFRDA

In 1999, the Government of India launched a national project called "OASIS" (Old Age Social and Income Security) to review policies related to old age income security. Following the recommendations from the OASIS report, the Government introduced a new Defined Contribution Pension System. This system applies to new employees joining Central and State Government services, except for the Armed Forces, replacing the previous Defined Benefit Pension System.

The Interim Pension Fund Regulatory and Development Authority (PFRDA) was established by the Government of India on 23rd August 2003 to promote, develop, and regulate the pension sector in India. Initially set up as an interim body, it became a statutory entity following the enactment of the PFRDA Act, on 19th September 2013, which came into effect on 1st February 2014.

The authority ensures the orderly growth and regulation of the National Pension System (NPS), which was introduced on 1st January 2004 as a contributory pension scheme for new government employees (except the Armed Forces). On 1st May 2009, NPS was expanded to include all citizens of India, including self-employed professionals and individuals in the unorganized sector on a voluntary basis.

Preamble of PFRDA Act, 2013

The Preamble of the PFRDA Act, 2013, defines the authority’s primary function as:

“… to promote old age income security by establishing, developing, and regulating pension funds, to protect the interests of subscribers to schemes of pension funds and for matters connected therewith or incidental thereto.”

Head Office

Pension Fund Regulatory and Development Authority (PFRDA)

E-500, Tower E, 5th Floor

World Trade Centre, Nauroji Nagar, New Delhi - 110029

Our Vision

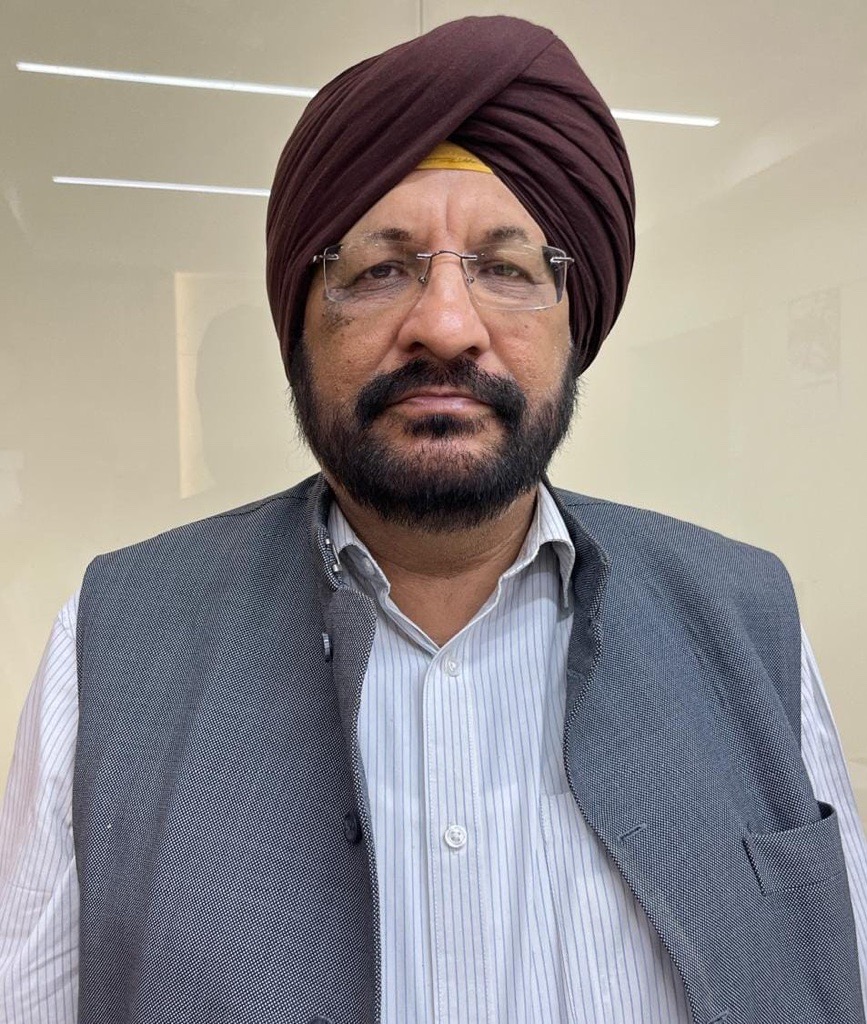

Present Composition of the Authority

(as on 20th June 2025)

As per Section 4 of the PFRDA Act, 2013, the Authority consists of:

- Chairperson

- Three Whole-Time Members

- Three Part-Time Members

These members are appointed by the Central Government and are selected based on their expertise in economics, finance, or law, ensuring leadership with integrity and professional standing.